Yesterday, like most of us, I casually checked my phone and saw an SMS from my bank.

It mentioned something called “mandatory Positive Pay Confirmation System for cheque payments.”

Honestly?

I had no idea such a system even existed.

No prior email. No explanation earlier. Just a message that sounded serious — almost alarming. That curiosity (and slight concern) pushed me to dig deeper. What I discovered is something every cheque user in India must understand today.

This article is based on that real experience — explained simply, clearly, and practically.

related article: cheque vs cheque return

What Exactly Is the Positive Pay Confirmation System?

The positive pay confirmation system is a bank-level security process designed to protect customers from cheque fraud.

In simple words:

If you issue a cheque, you must inform your bank in advance about its details.

Only then will the bank honour that cheque.

The bank cross-checks:

- Cheque number

- Date

- Amount

- Payee name

If anything doesn’t match, the cheque won’t be cleared.

Why Did This SMS Come Now — All of a Sudden?

That was my first question too.

The answer lies in rising cheque fraud cases and stricter banking controls guided by the Reserve Bank of India. Banks have been instructed to add extra verification layers for high-value cheque payments.

Instead of silently processing cheques, banks now want confirmation from the person issuing the cheque.

So when you receive that SMS, it’s not promotional or optional — it’s protective.

The Real Reason Banks Introduced Positive Pay

Cheque fraud doesn’t always look dramatic. Sometimes it’s as simple as:

- A changed digit in the amount

- A replaced payee name

- A misused signed cheque

Once money is gone, recovery is painful and slow.

The positive pay confirmation system ensures that:

No cheque gets cleared unless the drawer explicitly approves the details.

That single step blocks most fraud attempts.

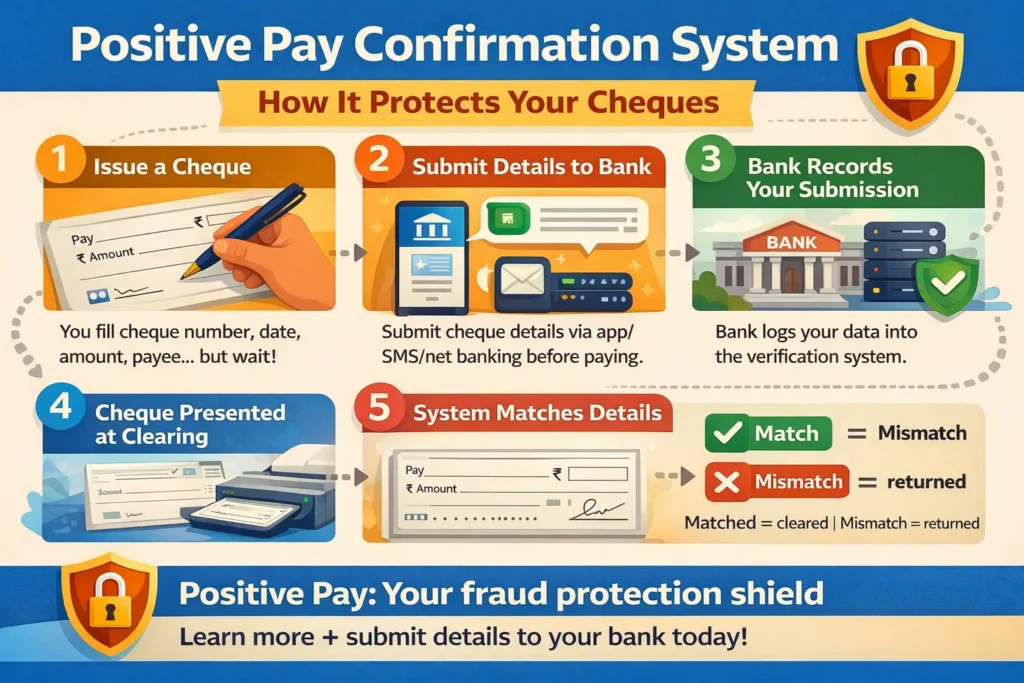

How the Positive Pay Confirmation System Actually Works

Here’s the process in real-life terms:

- You issue a cheque to someone

- Your bank asks you to submit cheque details (online / app / branch)

- The bank records these details

- When the cheque is deposited, the system matches the information

- ✅ Match → Cheque cleared

- ❌ Mismatch → Cheque stopped

Simple. Effective. Necessary.

you may also like to read: GOOD BYE Bounced cheque:How India’s UPI era is bringing a positive change for MSMEs.

How I Found Out Where to Submit Positive Pay

After the SMS, the next confusion was obvious — “Where do I even submit this?”

Most banks like State Bank of India, HDFC Bank, ICICI Bank allow submission through:

- Internet banking

- Mobile banking apps

- Branch visits

- Customer support channels

Once you know where to click, it usually takes less than 3 minutes.

Is Positive Pay Mandatory for Everyone?

Not for every cheque — but definitely for high-value ones.

Most banks apply this rule for cheques above ₹2 lakh to ₹5 lakh. The exact limit varies by bank, but the direction is clear:

👉 High-value cheques without confirmation = high risk

What Happens If You Ignore That SMS?

This is the part many people don’t realise.

If Positive Pay is mandatory and you skip it:

- The cheque may not be processed

- It can be returned unpaid

- Payment delays can occur

- Business credibility may take a hit

For businesses and MSMEs, this can mean lost trust, delayed deals, and cash flow problems.

Who Should Pay Maximum Attention to This System?

- Business owners

- MSMEs issuing supplier cheques

- Property buyers & sellers

- Trusts, societies, institutions

- Anyone issuing cheques regularly

If cheques are still part of your payment routine, Positive Pay is now part of banking reality.

Why the Positive Pay Confirmation System Is Actually a Good Thing

After understanding it fully, my perspective changed.

Benefits include:

- Strong protection against cheque fraud

- Full control over outgoing payments

- Fewer disputes

- Safer traditional banking

It turns cheques from a risky paper instrument into a verified payment instruction.

Final Thought: That SMS Was a Wake-Up Call

Like many people, I had been issuing cheques without thinking much about what happens in between. That one SMS changed that.

The positive pay confirmation system isn’t just a banking update — it’s a necessary evolution to protect hard-earned money.

So next time your bank sends such a message, don’t ignore it.

Understand it. Use it. Benefit from it.

✍️ About the Author

Tabrez is the voice behind BusinessZindagi, a platform focused on simplifying business, banking, compliance, and entrepreneurship for everyday Indians. With hands-on exposure to real-world financial processes, MSME challenges, and regulatory changes, he writes from the perspective of a practical user, not a textbook expert.

⚠️ Disclaimer

Important: This article is for informational purposes only and does not constitute financial or legal advice. Always refer to your bank’s official guidelines before taking action.

AI Disclaimer: Portions of this article were assisted by AI-based content generation tools. Every effort has been made to ensure accuracy, but human verification and professional advice are recommended.

🔗 Authentic Sources & References

- RBI Positive Pay System FAQs (cheque clearing info) — https://www.rbi.org.in/commonman/english/scripts/FAQs.aspx?Id=273 Reserve Bank of India

- ClearTax explanation of Positive Pay System — https://cleartax.in/s/positive-payment-system cleartax

- SBI Positive Pay System details — https://sbi.co.in/web/personal-banking/information-services/positive-pay-system SBI