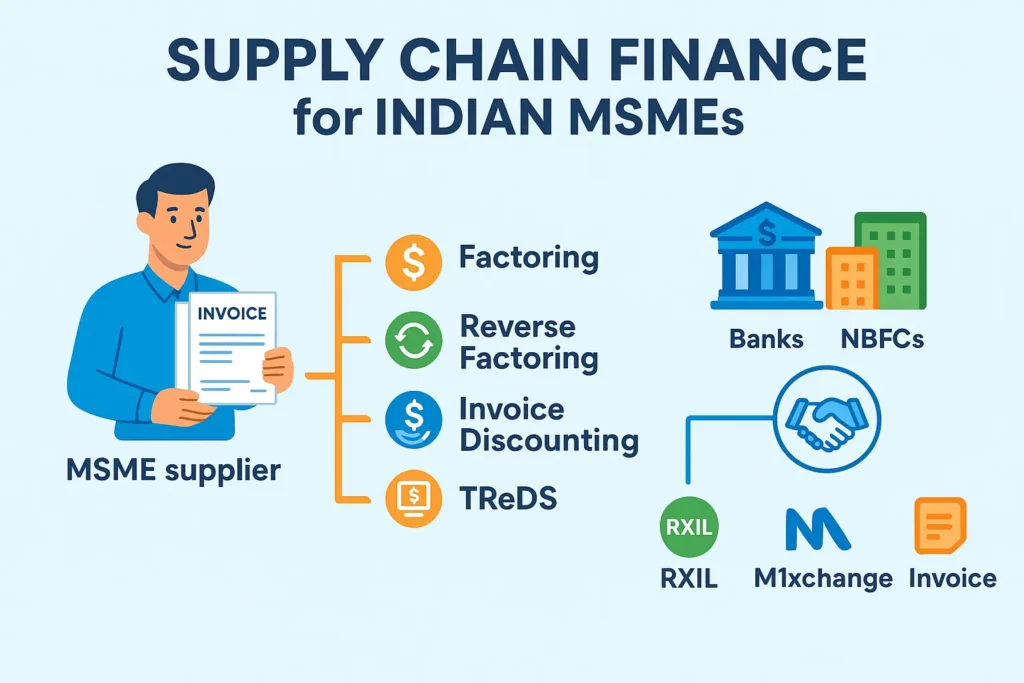

For small businesses and MSMEs, one of the biggest challenges is delayed payments from large buyers. Supply chain finance (SCF) provides a solution by enabling early access to funds against invoices. By using tools like factoring and reverse factoring, businesses can unlock working capital, reduce cash flow stress, and focus on growth.

What is Supply Chain Finance?

Supply chain finance is a set of financing solutions that allow MSMEs to receive early payments on their receivables. It improves liquidity for suppliers while offering buyers extended payment terms.

You may also like to read:TReDS in India 2025: Unlocking Instant Cash Flow for MSMEs & Startups

Types of Supply Chain Finance Options for MSMEs

- Factoring – Supplier sells invoices to a factor (bank/NBFC).

- Reverse Factoring – Buyer arranges financing for suppliers via banks/fintechs.

- Invoice Discounting – Suppliers borrow against unpaid invoices.

- TReDS Platforms – RBI-approved marketplaces for invoice discounting.

Comparison Table: Supply Chain Finance Options

| Financing Option | Who Initiates It? | How Funds Are Released | Credit Risk Based On | Best For MSMEs Who… |

|---|---|---|---|---|

| Factoring | Supplier | Factor advances 70–90% of invoice | Supplier or Buyer (depending on recourse) | Need immediate cash flow and sell to multiple buyers |

| Reverse Factoring | Buyer (corporate-led) | Financier pays supplier early | Buyer’s credit rating | Supply to large corporates with strong credit profiles |

| Invoice Discounting | Supplier | Bank/NBFC lends against invoice | Supplier’s creditworthiness | Need flexibility and control over invoice funding |

| TReDS Platform | Supplier uploads invoice | Multiple financiers bid digitally | Buyer’s credit rating | Want transparent, RBI-regulated, competitive discounting |

Who Provides Supply Chain Finance in India?

- Banks: SBI, HDFC, ICICI, Axis, Kotak.

- NBFCs & NBFC-Factors: Provide factoring and invoice financing.

- Fintech Platforms: Cashinvoice, Clear, Lendingkart, Indifi, InvoiceTrade.

- TReDS Exchanges: RXIL, M1xchange, Invoicemart, C2TReDS.

Global Comparison: India vs China & USA

China

China is the largest factoring market in Asia-Pacific, accounting for nearly 49.6% of APAC factoring revenue in 2023. Reverse factoring is widely used, driven by strong buyer-supplier ecosystems and large corporates offering financing programs to their SME suppliers.

🔗 Source

USA

The U.S. factoring market was valued at about USD 172 billion in 2024. While not every SME uses factoring, it is a significant financing option in industries like trucking, staffing, and manufacturing. Factoring is considered a mature but specialized financing tool.

🔗 Source

India

India’s adoption is growing but remains limited compared to China and the U.S. RBI-approved TReDS platforms (RXIL, M1xchange, Invoicemart, C2TReDS) financed over ₹1.4 lakh crore worth of invoices in FY24, but only tens of thousands of MSMEs are registered out of over 60 million MSMEs in the country. This means factoring/reverse factoring penetration is still under 1%, but rising quickly due to government mandates and fintech innovation.

🔗 RXIL Report | M1xchange Report

Why SCF Matters for MSMEs

- Faster access to funds.

- Reduced dependency on costly loans.

- Strengthened buyer-supplier trust.

- Transparent and digital processes.

Why Supply Chain Finance is Crucial for Startups and Indian MSMEs

New startups often struggle with delayed payments and limited access to traditional loans. Supply chain finance (SCF), through factoring or reverse factoring, provides immediate cash against invoices, bridging cash flow gaps and supporting growth without high debt. Buyer-led reverse factoring reduces credit risk for new businesses, while timely payments strengthen supplier relationships. Digital platforms like TReDS, RXIL, M1xchange, and fintech marketplaces enable quick onboarding and transparent financing, making SCF an essential tool for operational stability, growth, and credibility in India’s competitive MSME ecosystem.

FAQs

Q1: What is the difference between factoring and reverse factoring?

- Factoring is supplier-led, where MSMEs sell invoices to financiers.

- Reverse factoring is buyer-led, where large corporates arrange financing for their suppliers.

Q2: How do TReDS platforms help MSMEs?

- They connect MSMEs, buyers, and financiers on a single platform where invoices are discounted through competitive bidding.

Q3: Is supply chain finance cheaper than traditional loans?

- Yes, especially in reverse factoring, since financing rates are based on the buyer’s creditworthiness rather than the supplier’s.

Q4: Can small businesses without big buyers use SCF?

- Yes, fintech platforms and NBFCs provide invoice discounting and factoring options even for smaller invoices.

🔗 Sources & References

- IIBF Research Report 2023 – Impact of SCF on MSMEs

- NIBM Explainer – Supply Chain Finance Basics

- PwC India – Digitising Supply Chain Finance

- EPW Journal – Fintech & SCF for Small Businesses

- IDFC First Bank – What is Supply Chain Finance?

- Markets & Data – India SCF Market Outlook 2025

- RXIL & M1xchange – TReDS Invoice Discounting Reports (FY24)

✍️ About the Author

Tabrez writes about MSME finance, digital banking and business growth tools at BusinessZindagi.com. His content simplifies complex financial topics so small businesses can make faster, smarter decisions.