Why Calculating Working Capital is the First Big Test

For every entrepreneur, setting up an MSME is exciting. But soon after starting, reality hits — and often the toughest challenge is calculating working capital correctly. Working capital is the lifeline of any small business, yet it’s the most underestimated part of financial planning.

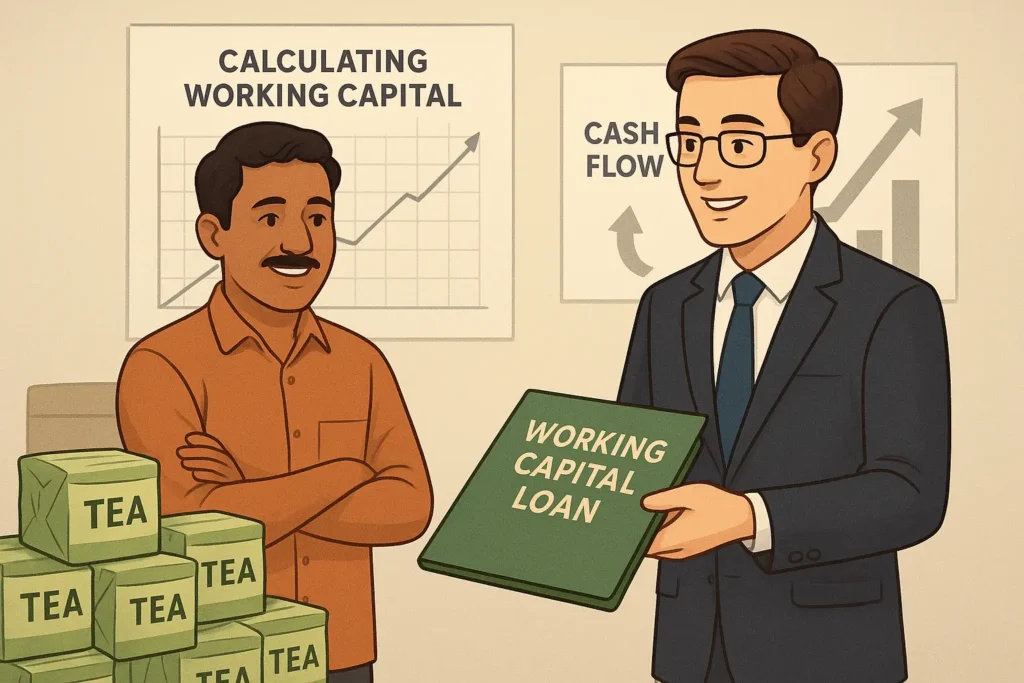

When I launched my tea packaging unit in Assam, I learned this lesson the hard way. Due to low working capital, I couldn’t stock enough tea at the right time. Prices went up, my costs increased, and production got disturbed often. Out of eagerness to start my business, I agreed to a loan from my banker even though the working capital loan wasn’t enough. Looking back, I now strongly suggest new MSMEs arrange at least 20–30% extra working capital in advance to handle contingencies.

Understanding the Importance of Calculating Working Capital

Calculating working capital is not just a formula (Current Assets – Current Liabilities). For MSMEs, it is a question of survival. It determines whether you can:

- Buy raw materials on time

- Pay salaries without delays

- Handle sudden increases in demand

- Manage slow payments from buyers

Without accurate calculations, liquidity dries up quickly, leading to credit stress and missed opportunities.

Why New MSMEs Struggle With Working Capital

- No credit history – Banks hesitate to lend to units without financial records,resulting in inadequate working capital to MSMEs

- Collateral issues – Many MSMEs lack assets to pledge for working capital loans, so they are not able to obtain enough working capital required.

- Delayed receivables – Payments from buyers often take months.

- Poor inventory planning – Overstocking or understocking disturbs cash flow.

- Underestimating needs – Entrepreneurs often misjudge while calculating working capital at the time of starting a msme unit

👉 My tea business is a perfect example. Had I calculated working capital with an emergency margin, I could have avoided much stress.

Government Support: Working Capital Loans for MSMEs

To ease the liquidity gap, several working capital loan schemes are available in India:

1. MUDRA Loans

Loans up to ₹10 lakh for micro and small businesses (Shishu, Kishore, Tarun categories).

2. CGTMSE Scheme

Collateral-free working capital loans up to ₹2 crore with guarantee cover.

3. SIDBI Working Capital Products

Customized short-term finance solutions for MSMEs.

4. Stand-Up India

Loans from ₹10 lakh to ₹1 crore, including working capital for greenfield projects.

5. NSIC Working Capital Loans

The National Small Industries Corporation (NSIC) helps MSMEs access working capital by financing raw material purchases and partnering with banks to extend working capital loans. For small businesses, this is a critical support system.

6. Composite Loan Facility

RBI allows banks to sanction a combined loan (term + working capital) up to ₹1 crore in a single window.

Practical Tips for Managing Working Capital in MSMEs

Effective managing working capital is as important as calculating it. Some tips for entrepreneurs:

- Maintain a 20–30% buffer – Always borrow slightly more than estimated.

- Negotiate supplier terms – Longer credit periods reduce pressure.

- Speed up receivables – Offer small discounts for early payments.

- Go digital – Use fintech platforms for invoice discounting and receivable financing.

- Monitor inventory – Don’t overstock; follow lean inventory practices.

- Cash flow forecasting – Review inflows and outflows monthly.

Lessons from My MSME Journey

From my tea packaging MSME, the most important lesson was simple:

➡️ While calculating working capital, always keep extra room for surprises.

Had I borrowed 20–30% more working capital in the beginning, I would have been better prepared for rising input costs and delayed payments. Every new MSME owner should plan for uncertainties, not just the best-case scenario.

Meta Title

Calculating Working Capital for MSMEs: Smart Strategies for Managing Working Capital and Avoiding Credit Crunch

Meta Description

Struggling with liquidity? Learn the importance of calculating working capital for MSMEs, tips for managing working capital effectively, and details on working capital loans from NSIC, MUDRA, SIDBI, and CGTMSE. Includes real MSME tea business experience.

FAQs

Q1. What does calculating working capital mean for an MSME?

It means finding out how much liquidity is available to run daily operations after meeting liabilities.

Q2. Why is calculating working capital important for new MSMEs?

It ensures businesses have enough cash to buy stock, pay staff, and survive receivable delays.

Q3. What happens if MSMEs underestimate working capital?

It can lead to stock shortages, higher costs, liquidity crunch, and missed opportunities.

Q4. How can MSMEs improve managing working capital?

By maintaining extra cash buffers, using digital finance tools, and negotiating better terms with buyers and suppliers.

Q5. Which government schemes provide working capital loans?

CGTMSE, MUDRA, SIDBI, Stand-Up India, NSIC, and RBI’s composite loan facility.

Q6. How does NSIC help with working capital?

NSIC supports MSMEs with raw material financing and bank tie-ups for working capital loans.

Q7. What percentage of extra working capital should MSMEs keep?

At least 20–30% extra, as a safeguard against unexpected costs and delayed payments.

Q8. Can MSMEs get collateral-free working capital loans?

Yes, through CGTMSE and MUDRA schemes.

Q9. How often should working capital be recalculated?

Monthly or quarterly, depending on the scale of business operations.

Q10. What is the difference between calculating and managing working capital?

Calculating is about estimating how much you need; managing is about efficiently using and controlling it once obtained.