Icici Bank Minimum Balance Change

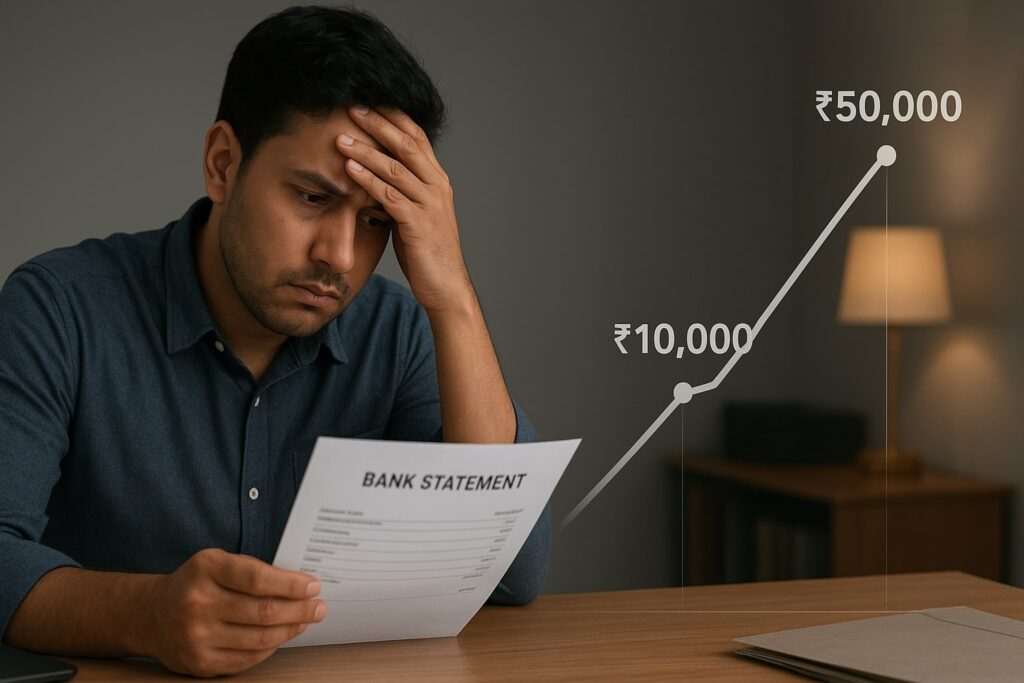

As of August 1, 2025, ICICI Bank has raised its monthly average balance (MAB) requirement for new savings accounts:

- Metro & Urban: increased from ₹10,000 to ₹50,000

- Semi-urban: from ₹5,000 to ₹25,000

- Rural: from ₹5,000 to ₹10,000

(Metropolitan hike is a staggering 400–500% increase.)The Economic TimesmintThe Times of India

Importantly, existing account holders remain under the old MAB limits.The Times of India Penalties for falling short include 6% of shortfall or ₹500, whichever is lower.mintBusiness Standard

2. Impact on Small Business Owners

- Cash flow strain: Small businesses often maintain lean balances—such a high requirement (₹50k) ties up working capital.

- Additional costs: Falling short results in penalties, chipping away at margins.

- Access inequality: Critics are calling it elitist, arguing it pushes out low-income or new entrepreneurs.www.ndtv.comNavbharat Times

3. What About the Average Sprite Saver?

For everyday savers, especially those not consistently maintaining high balances, this policy may feel restrictive and exclusionary:

- Penalties eat savings: Missed balances lead to charges and eroded funds.

- Trust eroded: While public banks are rolling back MAB requirements, ICICI’s hike may push savers toward zero-balance alternatives.Maharashtra Times

4. Comparing Savings Account Minimum Balance in Indian Banks

| Bank / Account Type | Metro/Urban MAB | Semi-urban MAB | Rural MAB |

|---|---|---|---|

| ICICI (new accounts) | ₹50,000 | ₹25,000 | ₹10,000 |

| HDFC | ₹10,000 | ₹5,000 | ₹2,500 (initial deposit)HDFC Bank |

| Axis Bank | ₹12,000 | ₹5,000 | ₹2,500Moneyview |

| Public Banks (e.g., SBI, PNB, Canara) | Zero-balance | Zero-balance | Zero-balanceMaharashtra Times |

| Other private banks (from BankBazaar comparison) | Varies: e.g., Kotak ( |

My personal experience of minimum balance requirements of banks

“I once held an ICICI current account where the minimum balance rules started eroding my funds—even when I had just a couple thousand rupees left. I’d fall short by a few hundred, and repeated penalties gradually emptied the account. That experience taught me how such fees can silently drain hard-earned money over time.”

It also happened with me long back with sbi current account.

This resonates even more today with the new ₹50k MAB—if you’d experienced penalties before, this could feel even more punishing.

You may also like to read:Understanding Non Performing Assets (NPA): A Real-Life Lesson for MSMEs and Entrepreneurs.

6. Solutions & Takeaways

- Consider zero-balance accounts: Public-sector banks, PMJDY/BSBDA accounts have no MAB.WikipediaMaharashtra Times

- Evaluate alternate banks: HDFC and Axis have moderate MABs; Kotak and RBL offer tiered plans.

- Know your banking habits: If your balances fluctuate, a zero or low-MAB account may save you money.

- Push for financial inclusion: Join conversations calling on regulators to ensure banking remains accessible.