In India’s fast-growing small business landscape, Non Banking Financial Companies (NBFCs) have become the backbone of MSME financing. When banks hesitate, NBFCs step in. When entrepreneurs need urgent working capital, NBFCs are the first to respond.

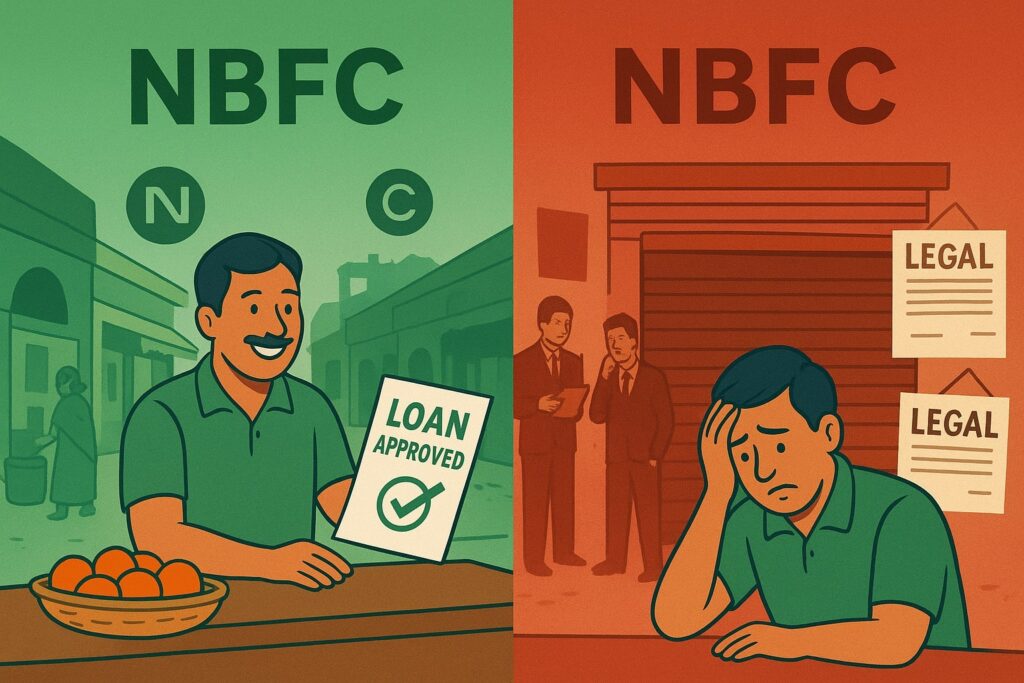

But behind the glitter of easy loans and quick approvals lies a hard truth:

NBFC loans can either help a business grow—or silently push it into a debt spiral.

This article uncovers both sides of the story—the good, the bad, and the urgent need for reform.

you may also like to read: Comparing Indian NBFC Finance for MSMEs with the U.S.: What India Can Learn

Why Non Banking financial companies (NBFC) Matter So Much for Indian MSMEs

1. They Bridge the Wide Credit Gap

Banks remain cautious and paperwork-heavy. NBFCs fill this gap by offering funds even to first-time borrowers, traders, and micro-units.

2. Speed Is Their Biggest Superpower

Loan approvals in 24–72 hours, minimal documentation, and doorstep service—this is unmatched by traditional banks.

3. Flexible Loan Products for Real Business Needs

- Working capital

- Inventory financing

- Invoice finance

- Small-ticket collateral-free loans

NBFCs build products around Indian business realities.

4. Deep Last-Mile Reach

NBFCs operate where banks often don’t—small towns, rural markets, and neighbourhood business clusters.*

The Bitter Reality: The Debt Trap I’ve Seen With My Own Eyes by Non Banking financial companies

BusinessZindagi is built on real experiences—and this topic hits close to home.

Case 1: The Shopkeeper Who Lost His Store

A local kirana owner took a small NBFC loan to expand his stock.

Sales slowed → EMI missed → penalties increased → harassment calls started.

Within months, the loan meant to help him grow became the reason he shut his shop permanently.

Case 2: A Relative Who Faced Recovery Agents

A close relative borrowed from a well-known NBFC.

High interest rates + short weekly repayment cycles = stress.

Soon, he was receiving:

• threatening calls

• repeated visits

• legal notices

These are not isolated cases—they reflect what thousands of small business owners silently go through every month.

NBFC convenience comes with a hidden cost, and many MSMEs don’t realise it until it’s too late.

The Risk Side of Non Banking financial companies (NBFC) Loans That Every MSME Should Know

1. High Interest Rates (18–30% or more)

NBFCs borrow at higher rates than banks, so MSMEs end up paying the price.

2. Short Repayment Cycles

Weekly or bi-weekly EMIs don’t match real business cash flows.

3. Aggressive Recovery Tactics

Despite RBI rules, harassment and intimidation still exist on the ground.

4. The Debt Spiral Effect

One missed EMI → penalty → increased EMI → more penalties → loan rollover → bigger debt.

5. No Financial Awareness

Many MSMEs don’t fully understand effective interest cost, foreclosure terms, or hidden charges.

The Positive Side: When Non Banking financial companies (NBFC) Loans Actually Work

Not everything is negative. If used wisely, NBFC loans can genuinely help small businesses grow.

✔ Fast Liquidity When Needed Most

NBFCs support urgent needs like bulk buying, supplier payment, or seizing a business opportunity.

✔ Support for New Entrepreneurs

Even if your credit score is weak or you don’t have property, NBFCs may still lend.

✔ Tailor-Made Financial Products

They understand the rhythm of Indian markets better than many banks.

✔ Support for Underbanked Segments

Women entrepreneurs, micro traders, and rural businesses benefit the most.

What the Government Must Do: Five Reforms of Non Banking financial companies (NBFC) India Cannot Delay

1. Cap Interest Rates for Small-Ticket Loans

A reasonable upper limit would prevent exploitation without hurting NBFC viability.

2. Strict Monitoring of Recovery Practices

RBI must directly monitor field recovery operations to prevent harassment.

3. Encourage Flexible Repayment Cycles

Monthly or quarterly cycles must be the default for MSMEs—not weekly collections.

4. Promote MSME Credit Insurance

Loan protection insurance can reduce both borrower and lender risk.

5. Financial Literacy for Borrowers

Before sanctioning a loan, NBFCs should be required to provide a one-page risk disclosure in simple language.

India Needs Non Banking financial companies NBFCs — But India Also Needs Protection for MSMEs

NBFCs are a lifeline.

But unregulated freedom has turned many into stress creators instead of growth partners.

If India wants its 6.3 crore MSMEs to grow sustainably, NBFCs must evolve into responsible lenders who balance:

speed + fairness + transparency + empathy

Real-life stories—like those from my own locality—show how urgent the need for reform truly is.

Conclusion: The Future of non banking finance companies NBFC Lending Must Be Responsible Lending

NBFC loans will continue to grow because MSMEs need fast, flexible credit.

But without reforms in interest rates, collections, transparency, and borrower protection, the debt trap problem will get worse.

India needs a lending ecosystem where:

- MSMEs grow

- NBFCs profit

- and no entrepreneur loses their business simply because they didn’t understand a loan.

Responsible lending is not just regulation—it’s the future.

References and sources:-

- Small Business Administration (SBA) 7(a) Loan Program — https://www.sba.gov/funding-programs/loans/7a-loans sba.gov+1

- Credit Guarantee Fund Trust for Micro and Small Enterprises (CGTMSE), India — https://www.cgtmse.in/ cgtmse.in+1

- Open Credit Enablement Network (OCEN), India — https://ocen.dev/ ocen.dev+1

About the Author

Tabrez

Founder of BusinessZindagi.com

A passionate business writer helping Indian entrepreneurs understand finance, insurance, MSME policy, and digital transformation.

Disclaimer

This blog post is for information & educational purposes only.

It should not be considered financial, legal, or investment advice. Readers should verify facts independently and consult professionals before making financial decisions.