Thousands of entrepreneurs apply for PMEGP loan every year — full of hope, business dreams and startup excitement.

But many applications get rejected…

not because the applicants are incapable…

…but because small mistakes slip through unnoticed.

Bankers, KVIC and DIC officers repeatedly say the same thing:

“Most PMEGP rejections could have been avoided with better preparation.”

In this post, let’s decode the real PMEGP loan rejection reasons — explained in simple language — along with practical fixes you can apply.

The Most Common PMEGP Loan Rejection Reasons

Based on scrutiny feedback, interview experiences and banker remarks — here are the most frequent causes of rejection.

1. Eligibility Gaps — The Silent Deal Breaker

Many applications fail before even reaching the bank because…

…the applicant doesn’t fully meet PMEGP eligibility conditions.

Common PMEGP Loan Rejection Reasons

include:

- Age below 18

- Aadhaar or identity mismatch

- Residential address doesn’t match project area

- Family member already availed PMEGP subsidy

- Applicant has already taken subsidy under another scheme

- Applying for expansion instead of a new unit

- Business activity not allowed under PMEGP

These are small details — but they matter.

💡 How to Avoid This

- Cross-check scheme eligibility before applying

- Ensure Aadhaar, PAN & bank records match

- Confirm no family member has previously used PMEGP subsidy

- Apply only for a new enterprise

👉 Add a short self-declaration — it strengthens credibility.

2. Weak Project Viability — Bank Feels The Business Won’t Work

Banks don’t reject applications randomly.

They reject when the project looks:

- unrealistic

- overpriced

- poorly planned

- or not profitable on paper

Typical viability-related rejection reasons:

- Business model not clearly explained

- Sales projections look exaggerated

- No proof of market demand

- Machinery list doesn’t match business activity

- No skill or experience related to the business

- Project cost too high without justification

To a banker — this signals risk.

💡 How to Fix This

- Write a realistic and bank-ready DPR

- Explain customer base & competition clearly

- Show practicality instead of over-ambition

- Attach experience / training certificates (if available)

- Use genuine machinery quotations

👉 A simple break-even & cash-flow table dramatically improves approval odds.

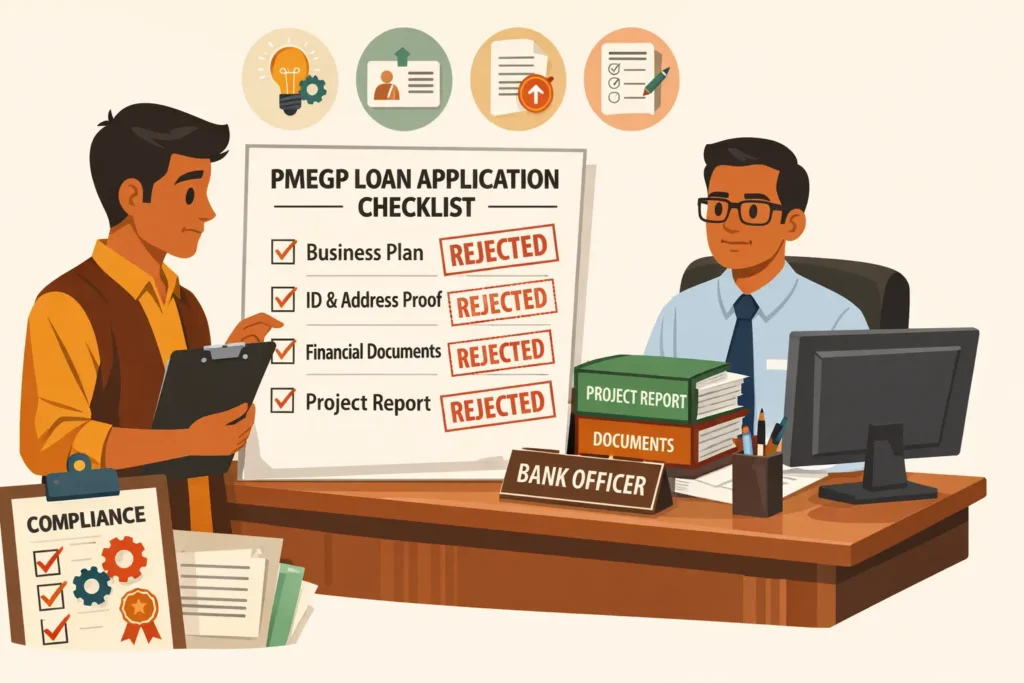

3. Documentation Gaps —It is one of the Biggest PMEGP Loan Rejection Reasons

Many strong ideas fail…

…just because documents are incomplete or mismatched.

Common mistakes:

- Missing DPR or outdated quotations

- Blurry / unreadable scanned copies

- Rental or lease papers not attached

- Bank statements not submitted

- Different names across documents

- Wrong address in application form

- Certificates not matching proposed activity

Officers do not have time to chase applicants for corrections.

💡 How to Avoid This

- Submit a properly indexed document file

- Use latest quotations with vendor details

- Attach valid land / rental proof

- Ensure same name across: Aadhaar ✔ PAN ✔ Bank ✔ Application ✔

👉 Upload clear scans — blurred images often lead to instant rejection.

4. Financial & CIBIL Issues — Strong Projects But Weak Banking Profile

Sometimes the project is good…

…but the financial history creates doubt.

Banks reject applications due to:

- Low or weak CIBIL score

- Active loan defaults

- High unpaid EMIs

- Very low or inconsistent bank balance

- Loan settlement remarks

- No proof of margin contribution

From the banker’s perspective — repayment risk increases.

💡 What You Should Do

- Improve CIBIL before applying

- Clear overdue loans or card dues

- Maintain steady banking activity for 3–6 months

- Show your capital contribution (where applicable)

👉 Avoid applying immediately after a loan settlement — wait & rebuild your profile.

you may also like to read: Understanding the Importance of CIBIL Score in Today’s Financial World

5. Procedural & Communication Issues — the most impotant PMEGP Loan Rejection Reasons

Nobody Talks About

Some applications fail simply because the applicant:

- didn’t attend scrutiny meeting

- didn’t respond to verification calls

- selected wrong activity category

- delayed submitting revised DPR

- didn’t follow-up after forwarding

- missed email or SMS updates

These are avoidable — but very common.

💡 How to Prevent This

- Track your application on the PMEGP portal

- Stay in touch with DIC / KVIC / KVIB officials

- Respond quickly to clarification requests

- Attend interviews & meetings without fail

👉 Keep your phone reachable & email notifications ON.

Simple Checklist to Avoid PMEGP Loan Rejection

Before submitting your application — ensure:

✔ Eligibility confirmed

✔ DPR realistic & bankable

✔ Valid quotations attached

✔ Banking history clean

✔ Proof of skills / experience added

✔ Same name across all documents

✔ Regular follow-up maintained

Small corrections → big difference in approval chances.

Who Usually Gets Higher PMEGP Approval?

Banks tend to approve projects that:

- generate local employment

- are practical & small-scale

- have relevant skill proof

- show realistic capital requirement

- demonstrate clear market demand

It’s not about applying for a big project…

…it’s about applying for a sustainable project.

PMEGP Loan Rejection reasons — Frequently Asked Questions

✅ Why Did the Bank Reject My PMEGP Loan?

Banks usually reject PMEGP loans due to incomplete documents, low credit score, poor project viability, insufficient margin money, or past loan defaults. Always confirm the exact reason before reapplying.

✅ What Happens If My PMEGP Loan Gets Rejected?

A rejection is not final. You can correct errors, improve your project report, strengthen your credit profile, and apply again or approach another bank.

✅ Can I Reapply for a PMEGP Loan After Rejection?

Yes. There is no restriction on reapplying. However, fix the issues that caused rejection—such as documentation or financial planning—to improve approval chances.

✅ What Credit Score Is Required for a PMEGP Loan?

There is no officially fixed score, but a CIBIL score above 700 is generally preferred by banks to consider you a low-risk borrower.

✅ How Long Does PMEGP Loan Approval Take?

Typically, approval can take 15 to 45 days, depending on document verification, project evaluation, and bank processing speed.

✅ Do All PMEGP Applications Get Bank Approval?

No. Even though PMEGP is a government-backed scheme, banks conduct their own risk assessment. Only financially viable projects with eligible applicants get approved.

✅ Can a Bank Reject a Government Scheme Loan?

Yes. Banks have the authority to reject applications if they find repayment risk, eligibility issues, or weak business plans.

✍️ About the Author

Tabrez writes about MSME schemes, entrepreneurship opportunities, and government programme insights — simplifying complex policy information for first-time business owners in India.

⚠️ Disclaimer

This article is for informational and educational purposes only. PMEGP rules, eligibility conditions and banking procedures may change based on official notifications and institutional policies. Some parts of this content were drafted with the assistance of AI tools such as ChatGPT for structuring and clarity. Readers are advised to verify details from official PMEGP / KVIC sources and consult authorised agencies or banks before making financial decisions.