If you’re running an MSME or planning to start one, you’ve probably heard of the MUDRA loan scheme—a government initiative under the Pradhan Mantri MUDRA Yojana (PMMY) that provides collateral-free loans up to ₹10 lakh.

But here’s the big question many entrepreneurs ask:

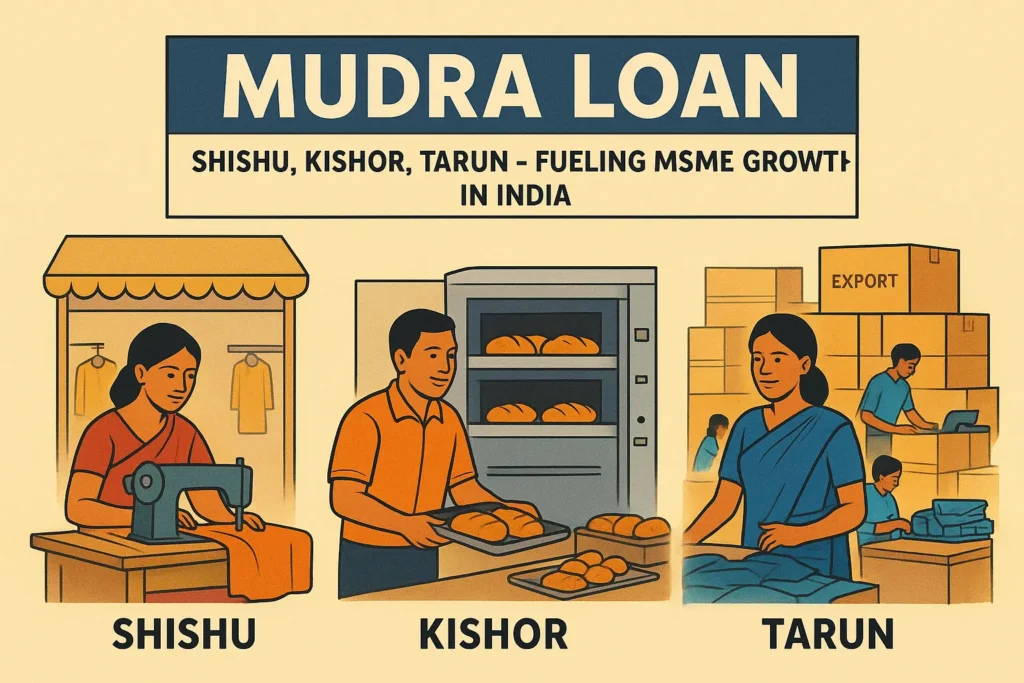

👉 Which loan category should I choose—Shishu, Kishor, or Tarun?

Let’s break it down in simple terms with examples so you can decide where your business fits.

What Are Shishu, Kishor, and Tarun in MUDRA Loan?

The MUDRA loan scheme is divided into three categories to support businesses at different stages:

- Shishu Loan (up to ₹50,000) – For startups and early-stage businesses.

- Kishor Loan (₹50,000 – ₹5 lakh) – For growing MSMEs that need working capital or moderate expansion.

- Tarun Loan (₹5 lakh – ₹10 lakh) – For established businesses ready to scale big.

You may also like: PMEGP Loan Scheme: A Catalyst for First-Generation Entrepreneurs and Startups in India.

1. Shishu MUDRA Loan: For Startups and New Businesses

- Loan Amount: Up to ₹50,000

- Who It’s For: Entrepreneurs just starting out, tiny MSMEs, street vendors, small shop owners.

- Example:

Rani, a young woman from Lucknow, wants to start a tailoring shop. She applies for a Shishu Mudra loan of ₹40,000 to buy a sewing machine, fabric, and rent a small workspace. This is the perfect fit because her business is in the idea/early stage.

👉 If you’re testing your idea or running a micro-business, Shishu is your entry point.

2. Kishor MUDRA Loan: For Growing MSMEs

- Loan Amount: ₹50,000 to ₹5 lakh

- Who It’s For: MSMEs with some track record, looking to expand, hire staff, or buy equipment.

- Example:

Rajesh owns a small bakery in Pune. He already sells cakes locally but wants to add pizza and snacks to his menu. He applies for a Kishor Mudra loan of ₹3 lakh to buy ovens, hire two bakers, and renovate his shop.

👉 If your MSME is stable but needs funds to grow, Kishor is your stepping stone.

3. Tarun MUDRA Loan: For Expansion-Stage Enterprises

- Loan Amount: ₹5 lakh to ₹10 lakh

- Who It’s For: Established MSMEs ready for large-scale expansion.

- Example:

Meena runs a small garment unit in Surat. Her clothes are now in demand in other states, but she needs bigger machines, more staff, and transport facilities. She applies for a Tarun Mudra loan of ₹8 lakh to expand her unit and start exporting.

👉 If your MSME has already proven itself and is scaling, Tarun gives you the boost to go big.

Key Benefits of MUDRA Loans

- Collateral-Free – No need to pledge property or assets.

- Flexible Use – Can be used for machinery, working capital, shop renovation, or business expansion.

- Government Support – Many banks and NBFCs prioritize women entrepreneurs and first-time borrowers.

FAQs on Shishu, Kishor, and Tarun Mudra Loans

Q1: What is the maximum loan amount under MUDRA Yojana?

Up to ₹10 lakh (Tarun category).

Q2: Can startups apply for MUDRA loans?

Yes. Startups and micro-businesses can apply under Shishu (up to ₹50,000).

Q3: Do I need collateral for a MUDRA loan?

No. All loans under the scheme are collateral-free.

Q4: Can I move from Shishu to Kishor or Tarun?

Yes. As your MSME grows, you can apply for a higher category loan.

Q5: What documents are required?

Basic KYC (ID & address proof), business plan, bank account statements, and in some cases MSME registration.

Conclusion

The MUDRA loan scheme is not one-size-fits-all. By dividing loans into Shishu, Kishor, and Tarun, the government has made sure every stage of an MSME—from startup to expansion—gets the support it needs.

- Choose Shishu if you’re starting small.

- Go for Kishor if your MSME is growing.

- Apply for Tarun if you’re ready to scale up.

👉 With the right Mudra loan, your business dream doesn’t have to wait