PMEGP Subsidy for SC and Rural Entrepreneurs: A Game-Changer for Inclusive Growth

Starting a business in India takes courage — but for many Scheduled Caste (SC) and rural entrepreneurs, the journey is twice as hard. Lack of collateral, limited financial access, weaker banking networks, and fewer market linkages often push brilliant business ideas into silence.

But that’s exactly where the Prime Minister’s Employment Generation Programme (PMEGP) steps in. The scheme has been designed not just to give loans — but to remove structural barriers that keep SC and rural entrepreneurs from entering the mainstream business ecosystem.

And the biggest catalyst inside this scheme?

👉 Higher subsidies + Lower own contribution for SC and rural beneficiaries.

This single policy shift has turned PMEGP into one of India’s most impactful tools for inclusive entrepreneurship.

you my also like to read: 10 Common Mistakes in PMEGP loan to Avoid While Applying.

Why SC and Rural Entrepreneurs Need Special Support as pmegp subsidy

Entrepreneurship is heavily influenced by the conditions people start with.

1. Historical gaps for SC communities

Generations of social and economic exclusion have created limited financial security for many SC families. Even small investments become risky without stable reserves or collateral. PMEGP helps break this cycle by reducing financial pressure and increasing institutional trust.

2. Structural disadvantages in rural India

- Limited job opportunities beyond agriculture

- Poor banking penetration

- Migration as the only escape from unemployment

PMEGP turns rural entrepreneurship from a challenge into an opportunity by reducing the upfront cost and increasing the viability of starting a business within the village itself.

Higher pmegp subsidy Lower Own Contribution: The Real Game-Changer

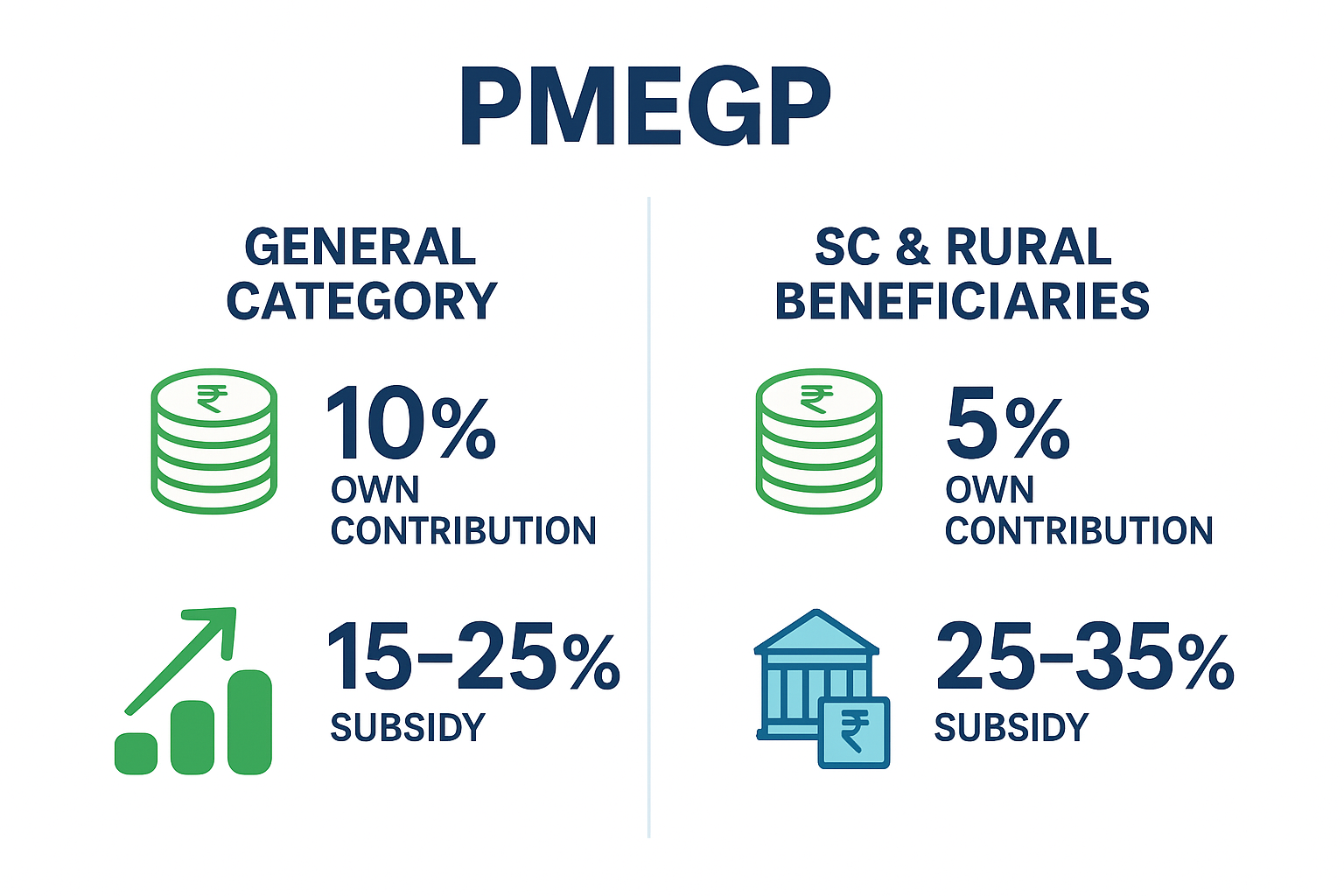

Under PMEGP, the rules are specially designed to favor SC and rural entrepreneurs:

| Beneficiary Type | Own Contribution | Subsidy (Urban) | Subsidy (Rural) |

|---|---|---|---|

| General Category | 10% | 15% | 25% |

| SC/ST, Women, OBC, Minorities, Rural | 5% | 25% | 35% |

What this means in practical terms:

- An SC entrepreneur in a rural area pays only 5% of the project cost.

- The government gives a massive 35% subsidy.

- The bank finances the remaining amount as a loan.

Example:

For a ₹10 lakh rural project:

- SC entrepreneur invests: ₹50,000

- Govt subsidy: ₹3,50,000

- Bank loan: ₹6,50,000

This makes entrepreneurship affordable, accessible, and less risky — especially for first-generation entrepreneurs.

How pmegp subsidy Empowers SC Entrepreneurs

1. Breaks the credit barrier

Collateral issues and bank hesitations are common. A high subsidy cushion makes banks more confident about lending.

2. Encourages first-time business owners

Low personal investment reduces fear and increases willingness to take calculated risks.

3. Boosts economic mobility

Entrepreneurship becomes a pathway for SC individuals to move beyond traditional professions into new-age business opportunities.

Why Rural Entrepreneurs Benefit from pmegp subsidy Even More

The scheme is intentionally designed to bring economic activity back to India’s villages.

1. Higher rural subsidy (35%)

Setting up a business locally becomes financially attractive.

2. Diversification beyond agriculture

Rural entrepreneurs can start:

- Food processing units

- Manufacturing workshops

- Service units

- Craft & textile units

- Repair and maintenance businesses

3. Local job creation

One successful PMEGP unit can create 5–10 jobs, reducing migration and strengthening village economies.

Impact So Far: What PMEGP Has Achieved

According to government data:

- Over 8 lakh+ projects have been sanctioned.

- Total jobs generated exceeded 70 lakh, with rural areas accounting for the majority.

- A significant share of beneficiaries are SC entrepreneurs.

- SC women in multiple states have opened tailoring units, food processing units, micro-manufacturing shops, and local service hubs.

These numbers show that PMEGP is not just a loan program — it is a tool of economic upliftment for marginalized communities.

Challenges Still Ahead

While PMEGP is powerful, some barriers remain:

❗ Awareness Gap

Many SC and rural entrepreneurs simply do not know about subsidies available to them.

❗ Banking Delays

Loan approvals and subsidy releases may take time due to paperwork.

❗ Skill & Training Needs

Business management skills are still limited among many first-time entrepreneurs.

However, the government is strengthening:

- Digital tracking of applications

- Entrepreneurship development training

- Simplified documentation

This is steadily improving the scheme’s efficiency.

Final Thoughts

The PMEGP subsidy for SC and rural entrepreneurs is more than a financial benefit — it’s a structural correction, a chance to create an equal platform, and a push toward inclusive economic growth.

For SC and rural youth with dreams of becoming entrepreneurs, the message is simple and powerful:

Your business dream is not out of reach — PMEGP can help you turn it into reality.

FAQs

1. Who is eligible for the PMEGP subsidy?

SC/ST, women, minorities, OBCs, ex-servicemen, and rural entrepreneurs benefit from higher subsidies.

2. Do I need collateral for the loan?

Projects up to ₹10 lakh (service) and ₹25 lakh (manufacturing) usually do not require collateral under Credit Guarantee schemes.

3. Is prior business experience required?

No, PMEGP supports first-time entrepreneurs.

4. Does my village location increase my pmegp subsidy?

Yes. Rural units get 35% subsidy (higher than urban rates).

5. How do I apply?

Applications are accepted only through the official PMEGP online portal.

About the Author – BusinessZindagi

BusinessZindagi is dedicated to empowering Indian entrepreneurs, MSMEs, and first-generation business owners with practical guides, government scheme insights, and real-world business strategies. Our mission is simple — to make business knowledge accessible, actionable, and growth-focused for every Indian entrepreneur.

Authentic Sources & Clickable References

🔗 PMEGP Official Portal (KVIC)

https://www.kviconline.gov.in/pmegp/

🔗 Ministry of MSME – PMEGP Guidelines

https://msme.gov.in

🔗 Udyam Registration Portal

https://udyamregistration.gov.in