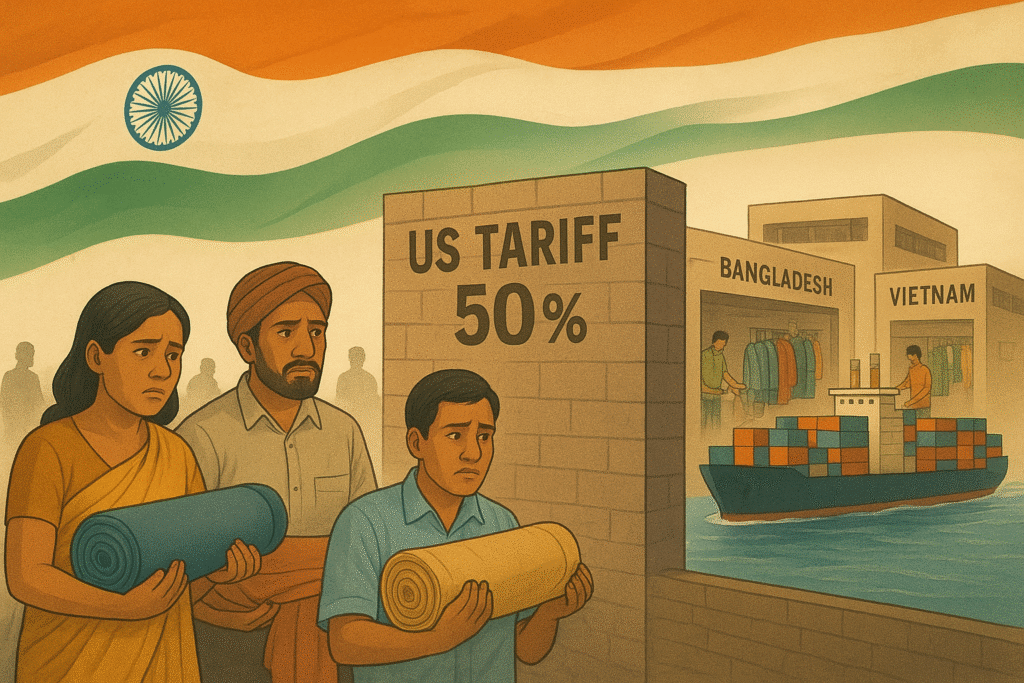

The Indian textile industry—powered largely by Micro, Small, and Medium Enterprises (MSMEs)—has long been a backbone of the country’s exports. However, the sector now faces one of its toughest challenges.

On August 27, 2025, the United States imposed an additional 25% tariff on Indian goods, taking the total tariff burden to nearly 50% on many products. For readymade garments (RMG), the figure climbs even higher—up to 61%.

This move puts India’s textile MSMEs at a serious disadvantage compared to rivals like Bangladesh and Vietnam, who enjoy far lower tariff rates. For an industry already battling rising costs, fluctuating demand, and intense global competition, the timing couldn’t be worse.

Why the US Tariff Matters So Much

The United States is India’s largest export market for textiles and apparel, accounting for almost 27% of total textile exports. Within this, MSMEs contribute close to 45%, making them critical players in the supply chain.

When tariffs rise so sharply, the fallout is immediate:

- Price Competitiveness Falls – Indian goods suddenly become far more expensive compared to Bangladeshi and Vietnamese alternatives.

- Orders Get Diverted – Global retailers like Walmart, Target, and Macy’s naturally shift sourcing to cheaper destinations.

- Margins Shrink – MSMEs, already operating on thin profit margins, face even tighter financial pressure.

- Jobs at Risk – The textile sector employs millions, particularly women in rural and semi-urban areas. A fall in orders could trigger widespread job losses.

In short, the US tariff is not just an economic setback—it’s a threat to livelihoods and industry survival.

India vs Competitors: A Tough Comparison

To see the scale of the problem, let’s compare India with its competitors:

- India – Facing up to 61% tariffs on readymade garments.

- Bangladesh – Enjoys zero or minimal tariffs under preferential trade agreements like GSP.

- Vietnam – Pays around 15% tariffs thanks to free trade agreements with the US.

For a US buyer, a shirt sourced from India could cost 30–40% more than one from Bangladesh. Naturally, cost-conscious retailers will look elsewhere.

The Impact on Textile MSMEs

The consequences of the US tariff hike will ripple through the entire MSME textile ecosystem:

- Fewer Export Orders – A drop in demand from US buyers.

- Idle Production Units – Many factories may operate below capacity or even shut down temporarily.

- Financial Stress – With reduced cash flow, many MSMEs may default on loans or delay payments to workers.

- Employment Concerns – India’s textile sector employs over 45 million people; job security will be at risk.

- Foreign Exchange Pressure – Lower exports will impact India’s foreign currency reserves and trade balance.

How Can Textile MSMEs Respond?

While the challenge is serious, MSMEs are known for their resilience and adaptability. Here are some strategies they can adopt:

1. Diversify Export Markets

MSMEs should look beyond the US. Regions like Europe, the Middle East, Africa, and Latin America offer emerging opportunities for textile exports.

2. Focus on Value-Added Products

Competing only on price is risky. Instead, MSMEs can carve niches in premium textiles, organic fabrics, sustainable clothing, and ethnic wear, where buyers are willing to pay more.

3. Strengthen Domestic Market Sales

India’s own fashion and retail market is booming. Selling directly to Indian consumers through e-commerce platforms like Amazon, Flipkart, and Myntra can help MSMEs reduce reliance on exports.

4. Collaborate in Clusters

Forming industry clusters allows MSMEs to share technology, reduce production costs, and negotiate better deals with both suppliers and buyers.

5. Leverage Government Schemes

MSMEs should actively use support programs such as:

- RoDTEP (Remission of Duties and Taxes on Export Products)

- PLI (Production Linked Incentive) scheme for textiles

- Export Credit Guarantee Corporation (ECGC) for risk protection

These can help soften the blow of tariffs.

What Role Should the Government Play?

MSMEs cannot tackle this crisis alone. Strong policy intervention is needed.

The government should:

- Negotiate trade deals with the US to seek tariff relief.

- Expand FTAs with other regions so that MSMEs are not overly dependent on the US market.

- Offer export incentives and subsidies to make Indian textiles competitive again.

- Invest in technology upgradation to move Indian MSMEs up the value chain.

Without such steps, India risks losing ground permanently to Bangladesh and Vietnam.

Can India Still Compete?

Despite the challenges, India retains some major strengths:

- A skilled and large workforce.

- A diverse textile base, from cotton to synthetics.

- Strong domestic demand that can cushion export losses.

If MSMEs adopt innovation-driven approaches and the government strengthens trade negotiations, India can still hold its place in the global textile market.

Conclusion

The recent US tariff hike of 25%, raising total tariffs to nearly 50%, is a tough blow for Indian textile MSMEs. With readymade garments now facing up to 61% tariffs, India’s competitiveness is under serious threat—especially compared to Bangladesh and Vietnam.

However, this crisis can also serve as a wake-up call. By diversifying markets, focusing on value-added products, leveraging government support, and strengthening domestic sales, Indian MSMEs can adapt and survive.

The road ahead will not be easy, but India’s textile MSMEs have proven resilient time and again. With the right mix of policy support and business innovation, they can overcome the tariff storm and emerge stronger in the global marketplace.

FAQs on US Tariff and Textile MSMEs

Q1. What is the current US tariff on Indian textiles?

As of August 27, 2025, the US has imposed an additional 25% tariff, raising total tariffs on many products to nearly 50%. For readymade garments, tariffs can go as high as 61%.

Q2. Why are Bangladesh and Vietnam at an advantage?

Bangladesh enjoys zero or very low tariffs under the Generalized System of Preferences (GSP), while Vietnam benefits from free trade agreements with the US. This makes their exports cheaper compared to India.

Q3. Which textile products from India are most affected?

Readymade garments (RMG), including shirts, trousers, dresses, and knitwear, are among the worst affected. These categories face the highest tariffs and stiff competition.

Q4. How big is the US market for Indian textile MSMEs?

The US accounts for about 27% of India’s textile exports. Since MSMEs contribute nearly 45% of total textile exports, they are heavily dependent on the US market.

Q5. What steps can MSMEs take to cope with tariffs?

MSMEs can:

- Diversify to non-US markets.

- Develop value-added, niche products like organic fabrics or premium apparel.

- Focus on domestic e-commerce opportunities.

- Collaborate in clusters to reduce costs.

- Leverage government export support schemes.

Q6. Can the Indian government help MSMEs in this situation?

Yes. The government can negotiate with the US, expand trade agreements with other regions, provide export subsidies, and promote technology adoption to make MSMEs globally competitive.

Q7. Will the US tariff impact jobs in India’s textile industry?

Yes. The textile sector is one of India’s largest employers. A reduction in export orders could lead to job losses, particularly affecting women workers in rural and semi-urban areas.