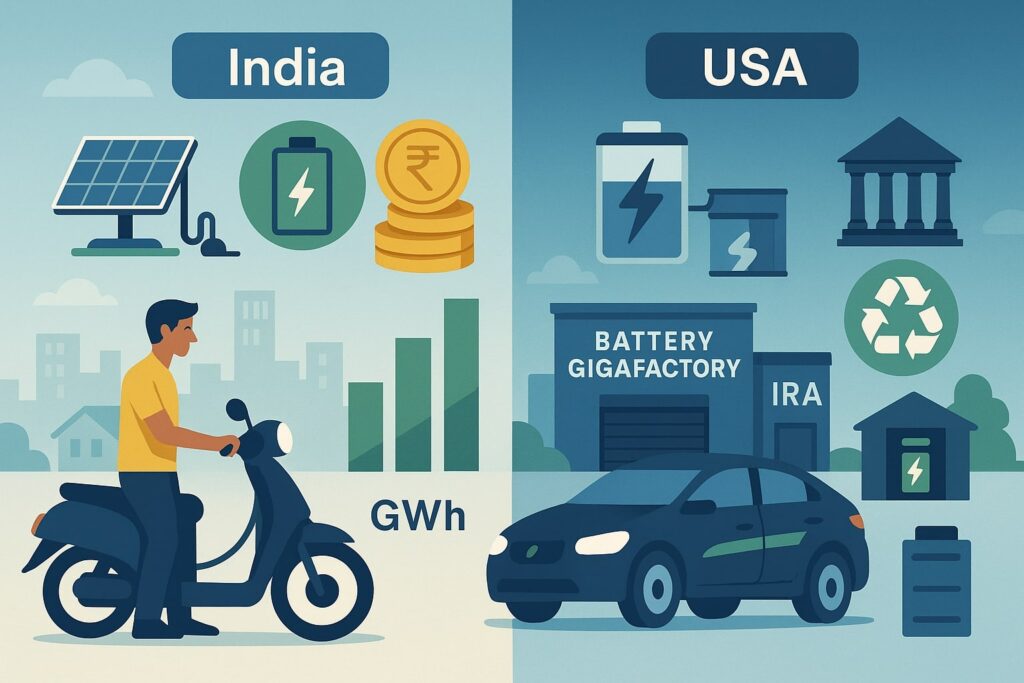

Lithium ion battery technology is fueling the green-energy transformation—from powering electric vehicles to storing renewable energy. Whether you’re researching lithium battery options for home solar, EVs, or industrial power backup, understanding how markets differ between India and the USA is key.

📈 Market Growth & Demand

India

- The lithium ion battery market in India was valued at USD 3.2 billion in 2024 and is projected to reach USD 9.6–18.9 billion by 2030/2031—implying a CAGR of ~12–23% RedditMordor Intelligence+2Wikipedia+2Wikipedia+2IMARC Group.

- A joint ICEA–Accenture report expects demand to grow at ~48% CAGR through 2030, reaching ~115 GWh annually across EV, consumer electronics, and energy storage sectors ETAuto.com+1The Times of India+1.

- Domestic production is accelerating—India aims to scale from ~3 GWh in 2018 to ~132 GWh by 2030 via the National Mission, PLI incentives, and new giga‑factories by Tata, Nsure, and others IBEF+1Business Wire+1.

USA

- U.S. production capacity is expanding rapidly with major investments. GM’s Ultium Cells facilities alone are expected to produce over 135 GWh by 2026 across Ohio, Tennessee, Michigan, and Indiana astuteanalytica.com+3Wikipedia+3grandviewresearch.com+3.

- Government-backed projects under the Inflation Reduction Act have spurred new investment, but many EV and battery plants have also been canceled due to policy uncertainty in early 2025 washingtonpost.com.

- Meanwhile, lithium producers like Albemarle continue to report strong demand and profits, even as lithium prices have dropped ~90% in the last two years—driven by increased volumes reuters.com+1reuters.com+1.

🏭 Manufacturing & Supply Chain

India

- India currently imports over 70% of battery cells and critical materials (lithium, cobalt, nickel), though recent discoveries—like 5.9 million tonnes of lithium in Jammu & Kashmir—may shift this over time Reddit+1Mordor Intelligence+1.

- The government has introduced schemes like FAME II, PLI for ACC manufacturing, and Critical Minerals Mission to encourage domestic cell factories and local sourcing gmiresearch.com+3marketresearch.com+3astuteanalytica.com+3.

- Innovation is emerging in recycling too—CSMCRI in Bhavnagar has developed a high‑purity lithium extraction method from spent cells, processing in hours instead of days The Times of India.

USA

- U.S. companies such as Ultium Cells, LG Energy Solution, Tesla, GM, and Redwood Materials are investing heavily in battery production and recycling infrastructure, often with federal support Wikipediareuters.comWikipediaWikipedia.

- General Motors is prioritizing lithium iron phosphate (LFP) and new LMR chemistry to reduce cost and cobalt dependence, along with plans for a Nevada lithium project and expanding domestic sourcing ft.com+1wsj.com+1.

♻️ Recycling & Sustainability

India

- Formal lithium recycling is nascent in India. It’s projected to reach only ~22–23 GWh by 2030, but innovation is accelerating with research breakthroughs like high‑purity, faster extraction methods IBEF.

USA

- Recycling leadership lies with companies like Redwood Materials and American Battery Technology Company, focusing on reclaiming >95% of metals and enabling circular supply chains Wikipedia+1Wikipedia+1.

🚗 Applications & Use Cases

India

- EV adoption is exploding: two‑ and three-wheeler electrification drives ~1.8 million EV registrations in 2022. Lithium batteries power this growth, especially in lower-cost LFP cells deployed in scooters, rickshaws, and public transport researchandmarkets.com.

- Energy‑storage systems are also surging to support India’s ambitious green energy targets: 450 GW renewables by 2030, requiring ~108 GWh BESS capacity marketresearch.com+1Mordor Intelligence+1.

USA

- U.S. battery demand is driven by EVs (including trucks and SUVs), grid storage projects, and backup systems. Tesla’s multi‑billion‑dollar LFP supply agreement with LGES reinforces domestic supply chain reshaping reuters.com+2reuters.com+2reuters.com+2.

- GM’s LMR batteries promise more range at lower cost—positioning the U.S. to compete on performance with lower reliance on cobalt-heavy chemistries theverge.com.

📊 Summary Table: India vs USA Lithium Battery Market

| Feature | India | USA |

|---|---|---|

| Market Size (2024/25) | USD 3–5 billion | Growing rapidly via Ultium, LG, GM, etc. |

| Growth Rate (CAGR) | ~20–48% | Strong, backed by IRA and federal funding |

| Domestic capacity | Emerging giga‑plants planned (~132 GWh by 2030) | Several facilities operational/planned (~>100 GWh) |

| Raw material sourcing | High import reliance; new domestic reserves | Expanding domestic mining (e.g. Nevada) |

| Recycling maturity | Early-stage innovation in extraction | Mature ecosystem via Redwood, ABTC |

| EV & Energy storage use | Two‑/three‑wheelers; grid storage expansion | Passenger EVs, trucks, grid & commercial storage |

🔍 Final Thoughts

Lithium ion battery growth is booming in both India and the USA—driven by EV adoption, renewable energy integration, and supply-chain investment.

- In India, explosive demand, favorable policy and new resource discoveries are creating room for domestic industry growth, with recycling and local production poised to catch up.

- In the USA, existing strengths in technology, capital, and policy support (IRA) are enabling major manufacturing scale-up, while recycling infrastructure is advancing toward closed-loop supply chains.