In India’s fast-changing economy, access to affordable finance is a game-changer for new entrepreneurs and startup ideas. The Prime Minister’s Employment Generation Programme (PMEGP scheme), implemented by the Khadi and Village Industries Commission (KVIC), is one such flagship initiative from the government that is transforming lives. It offers first-generation entrepreneurs the financial backbone to turn small ideas into thriving businesses — manufacturing, services or agro-based industries.

If you’re planning a new venture, the PMEGP loan could be your launchpad.

you may also like to read: 10 Common Mistakes in PMEGP loan to Avoid While Applying.

What is the PMEGP Scheme?

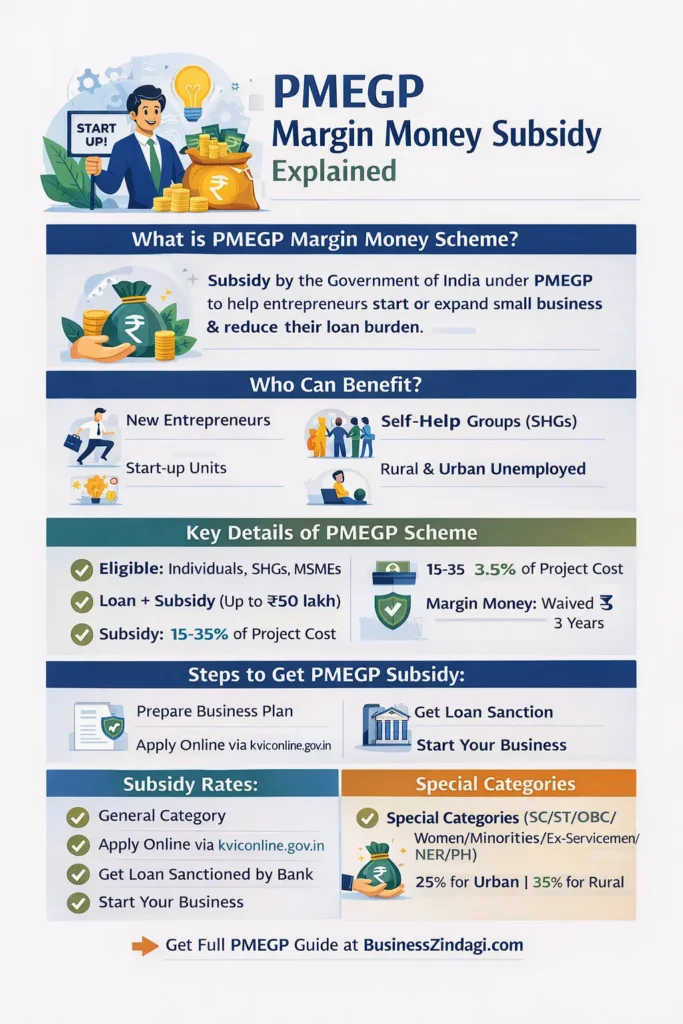

PMEGP is a credit-linked subsidy scheme under the Ministry of Micro, Small & Medium Enterprises (MoMSME) aimed at generating sustainable employment in rural and urban India. MSME+2myScheme+2 It supports those who have the skills and ideas but lack the capital. Under the scheme:

- The government provides a subsidy of 15% to 35% on the project cost. State Bank of India+1

- The remaining amount is financed as a bank loan under the PMEGP process.

- The scheme has been approved for the period up to FY 2025-26, with an allocation of about ₹13,554.42 crore for five years (2021-22 to 2025-26). myScheme

you may also like to read: How to Write a PMEGP Project Report That Gets Approved Collateral Free Loan for MSME: How Determination Helped Me Start My Tea Packaging Business Second Loan for Upgradation of PMEGP/MUDRA Units: Unlock New Growth for Your Business

Is the PMEGP Scheme Closed? — Latest 2025 Update

There has been confusion recently online about whether the PMEGP (Prime Minister’s Employment Generation Programme) is still active — with many individuals searching for answers like “Is PMEGP scheme closed?” or “Is PMEGP still running?”.

The short and clear answer is:

No — the PMEGP scheme is not closed. It continues to operate and support new micro-enterprise businesses in India.

This scheme has been officially approved to continue through the 2025–26 financial year as part of the Government of India’s ongoing efforts to promote self-employment and generate jobs in rural and urban areas. It provides subsidised credit support to eligible first-time entrepreneurs who wish to start manufacturing or service businesses. KVIC Online+1

Why Some People Think It Is “Closed”

There have been temporary technical issues and temporary portal closures on the official PMEGP application website during 2025. In some regions, the portal was partially inaccessible for a few months, and that led to misunderstandings that the entire scheme had been shut down. However, these were not official closures of the scheme itself — only temporary disruptions in the online system. The Times of India

Current Status

PMEGP remains a valid, Government-backed subsidy programme aimed at helping new entrepreneurs access loans with margin money subsidies. When the online portal is available, applicants can check application status and submit their forms through official channels or through local implementing agencies such as the Khadi and Village Industries Commission (KVIC), State Boards (KVIB), and District Industries Centres (DIC). KVIC Online+1

Key Benefits of PMEGP scheme

- Encourages self-reliance among youth and rural populations.

- Reduces financial burden via subsidy support.

- Covers both manufacturing and service sectors, giving wide business scope.

- Drives employment, especially in non-farm sectors.

- According to reports, the scheme has been creating thousands of jobs annually and helping many rural entrepreneurs. The Economic Times+1

you may also like to read: PMEGP Subsidy for SC and Rural Entrepreneurs: A Game-Changer for Inclusive Growth

Eligibility Criteria (Updated)

To benefit from the PMEGP scheme, you must meet certain conditions:

- Age: Minimum 18 years.

- Educational Qualification: Minimum 8th standard pass for projects above specified thresholds. State Bank of India

- Only first-generation entrepreneurs are eligible (i.e., the applicant must not have previously run a similar enterprise).

- Existing units or enterprises already availing subsidy under another government scheme are not eligible. State Bank of India

you may also like to read: Small Town entrepreneur Success Stories (2025) — Real Entrepreneurs Who Started Small and Made It Big

PMEGP scheme Loan Process: Step-by-Step

- Online registration via the official PMEGP portal: kviconline.gov.in/pmegp KVIC Online

- Fill the application form for your individual or institutional/co-operative venture.

- Submit your business/project report while applying.

- Bank processing: your application is forwarded to the bank for sanctioning.

- After the loan is approved and project gets inspected, the subsidy portion is credited to your account.

PMEGP Loan Amount & Subsidy Structure

- Manufacturing sector: Maximum project cost up to ₹25 lakh (or higher under revised guidelines) in many states. State Bank of India

- Service sector: Up to ₹10 lakh or more in some cases.

- Subsidy percentages:

- Rural areas: Around 25% for general category, higher for special categories. dkvib.delhi.gov.in+1

- Urban areas: Around 15% for general category, higher for special categories.

- Special categories (SC/ST, women, ex-servicemen): Up to 35% in rural areas.

PMEGP – Second Loan / Expansion Option

Many units that began under PMEGP and have successfully run for 3 + years can apply for a second loan under expansion/upgradation. Recently approved guidelines allow higher project cost under manufacturing (up to ₹1 crore) and service sector (up to ₹25 lakh) in many cases. State Bank of India+1

Why PMEGP is a Catalyst for Young Entrepreneurs

For first-generation entrepreneurs, the biggest hurdle is often lack of access to affordable capital and complexity of processes. PMEGP addresses both: it offers subsidy support plus bank loan access, and it is designed to be accessible even in rural and remote areas. By empowering individuals to become job creators rather than job seekers, it aligns with the “Atmanirbhar Bharat” vision.

Final Thoughts

The PMEGP scheme is more than just another government plan — it is a launchpad for entrepreneurship. If you’re planning to start your own venture, especially from a small town or rural background, this scheme can give you the financial boost you need to turn your idea into reality.

Visit the portal, assess your business idea, prepare a good project report, and take your first step toward building something of your own.

Short FAQs

Q1. What is the PMEGP scheme?

PMEGP (Prime Minister’s Employment Generation Programme) is a credit-linked subsidy scheme by the Government of India to promote self-employment through micro-enterprises in rural and urban areas. MSME

Q2. Who is eligible for a loan under PMEGP?

An Indian citizen age 18+ with at least 8th grade education (for larger projects), a first-generation entrepreneur, and a viable business plan. State Bank of India

Q3. How much loan can I get under PMEGP?

Manufacturing sector: Up to around ₹25 lakh (or more under revised rules). Service sector: Up to ₹10 lakh or more. Subsidy of 15%–35% depending on location and category. dkvib.delhi.gov.in+1

Q4. How do I apply online?

Go to the PMEGP portal: kviconline.gov.in/pmegp KVIC Online

Q5. Is there a second-loan option under PMEGP?

Yes. Existing PMEGP units that have run successfully for some years can apply for expansion loans of higher amounts. State Bank of India

About the Author

Tabrez – Founder, Business Zindagi

Tabrez is a tea trader, exporter, and first-generation entrepreneur. Drawing from real trade and export experience, he writes actionable guides on schemes, compliance, and business growth for MSMEs and rural entrepreneurs.Disclaimer

This article is for informational purposes only and does not constitute financial, legal, or trade advice

AI Disclosure

This content was created with the assistance of AI and reviewed for accuracy, structure, and relevance for Indian MSMEs.